Attention Indian CAs & Accountants

Start Your Global Accounting Outsourcing Practice Today

US, UK, Auatralia, Canadian, Singapore, New zealand & UAE businesses are actively outsourcing their bookkeeping and accounting work.

This is your opportunity to earn in dollars & pounds — right from India!

What is Foreign Accounting Outsourcing Practice?

Foreign Accounting Outsourcing Practice is a business model where Indian Chartered Accountants or accounting firms handle the accounting work of international clients on a contractual or recurring basis — remotely, through online tools and software.

Definition

Foreign Accounting Outsourcing Practice is a business model where Indian Chartered Accountants or accounting firms handle the accounting work of international clients on a contractual or recurring basis — remotely, through online tools and software.

Explanation

Foreign Accounting Outsourcing Practice (FAOP) means providing accounting, bookkeeping, and related financial services from India (or another low-cost country) to clients located abroad, typically in countries like the **USA, UK, Canada, Australia, UAE, etc.

Why It’s Growing Rapidly

Huge cost difference (India vs foreign CA/CPA hourly rates).

Time zone advantage (work done overnight, ready by next morning).

Skilled manpower (CAs familiar with IFRS, GAAP, and global tools).

Digital tools like QuickBooks Online, Xero, Hubdoc, Dext, Gusto, etc.

Target Clients

CPA firms (in USA/UK/AUS).

Small & medium businesses abroad.

E-commerce sellers (Amazon, Shopify, etc.).

Startups needing virtual accounting support.

Challenges Faced by Indian CAs & Accountants

- Limited growth in traditional practice

- High competition in the local market

- High competition in the local market

- Confusion about how to start outsourcing

- Lack of clarity on international compliance & tools

Turn Your Skills into Global Income!

- Start earning ₹1 lakh to ₹10 lakh+ per month by serving international clients all from India!

- Enjoy high-profit margins of 60–80% since operational costs in India are minimal.

- With the right strategy, systems, and mentorship, your accounting skills can become a powerful global business.

- With the right strategy, systems, and mentorship, your accounting skills can become a powerful global business.

Earning Potential Example !

A CA in India maintains books for a US-based e-commerce company using QuickBooks Online, reconciles accounts weekly, and sends monthly reports to the US owner — charging $800/month per client. With 20 such clients, monthly income can exceed ₹10–15 lakhs.

Common Services Offered

Bookkeeping & Accounting

Recording daily transactions in QuickBooks, Xero, Zoho Books, or Sage. Managing accounts payable & receivable.

Financial Reporting

Preparing monthly/quarterly financial statements and management reports.

Payroll Processing

Managing employee payroll for US/UK/AUS companies.

Tax Preparation Support

Preparing trial balances, reconciliations, and supporting schedules for CPAs (US tax season work).

Bank & Credit Card Reconciliation

ensures your financial records match bank and card statements, keeping accounts accurate and error free.

Year end Finalization and Audit Support

Involves preparing accurate financial statements, reconciling accounts, and assisting auditors to ensure compliance and a smooth audit process.

How To Start?

Learn foreign software (QuickBooks, Xero, Dext, Gusto).

Understand US/UK/AUS accounting and tax systems.

Build a LinkedIn or website presence targeting global clients.

Use email & LinkedIn outreach to approach CPAs or small businesses.

Deliver consistent quality & build long term relationships.

Start Your Foreign Accounting Outsourcing Practice with Confidence!

We have designed a comprehensive course for professionals who want to build and scale their Outsourcing Practice.

What You’ll Get in This Course

Practical Training (20 Hours)

Hands-on training on QuickBooks & Xero with real-life balance sheets and examples.

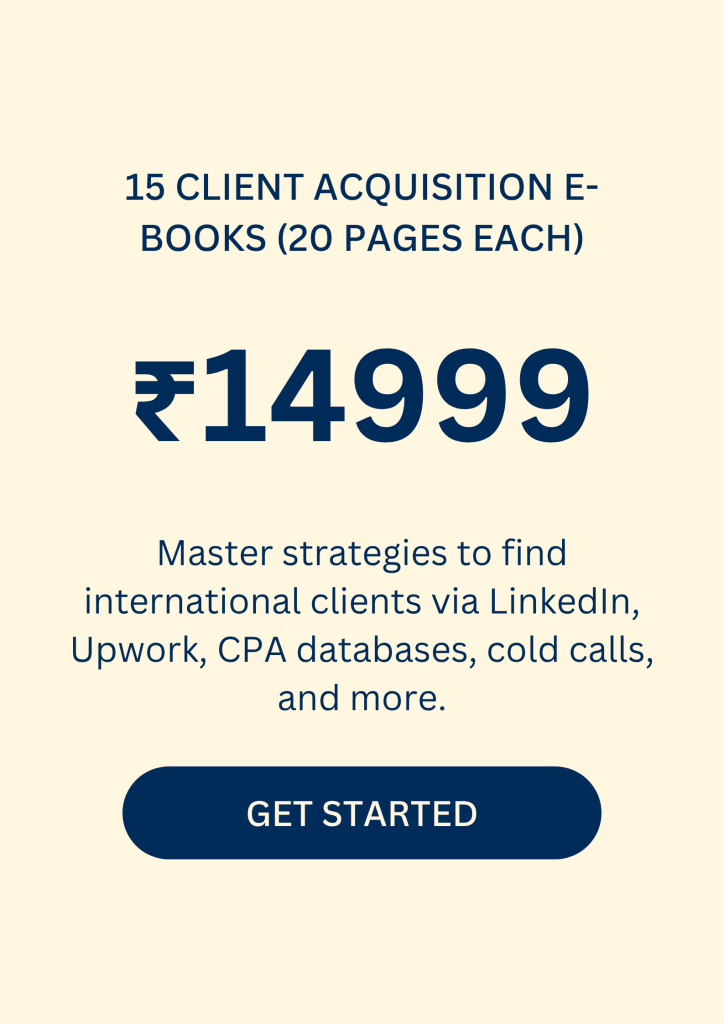

15 Client Acquisition eBooks

Proven strategies to acquire international clients.

10 Country Specific eBooks

Deep insights into outsourcing opportunities from top countries.

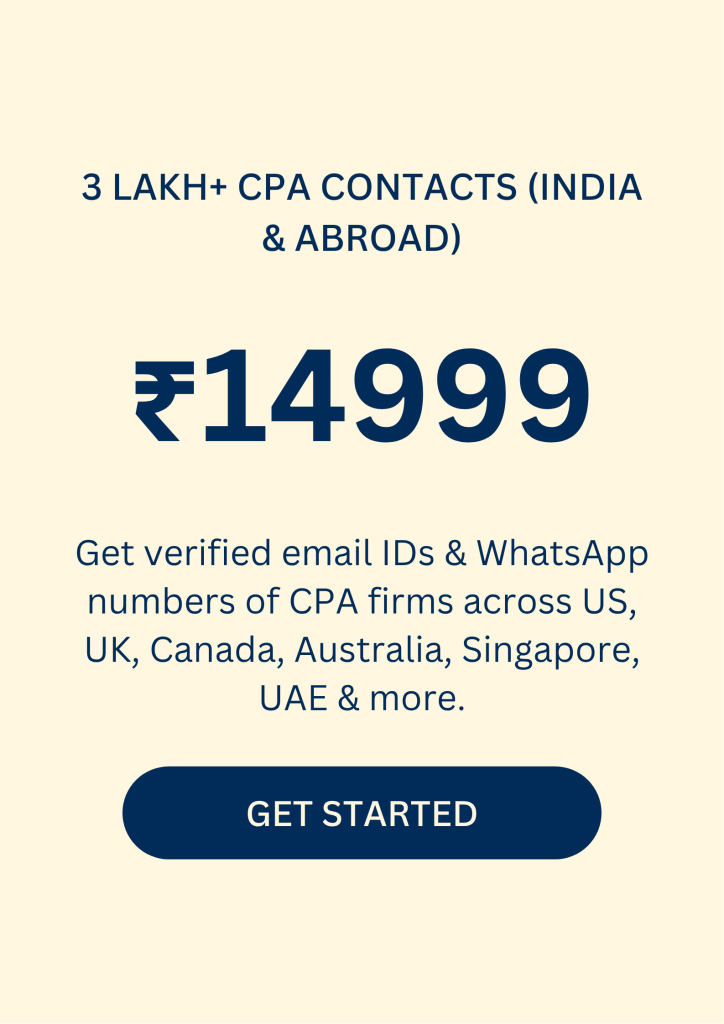

3 Lakh+ CPA & Business Owner Database

Excel Sheets with Name, Email id, Number and Address along with Websites of CPA Firms of Various Countries of India and Abroad

Doubt Clearing & Notes

Make your notes, ask your doubts, and get them resolved in a Live Doubt Session.

Exclusive WhatsApp Group

Continuous guidance, strategies, and community learning.

Mentorship Access

Guidance from experienced mentors on how to expand your outsourcing practice.

Global Career Guidance

Know whether CPA, ACCA, or ICAEW suits your career growth and opportunities abroad.

Why Join?

This course is not just about software training it’s a complete roadmap to kickstart and grow your Foreign Accounting Outsourcing Practice.

You will learn how to get international clients, handle projects, and scale globally.

👉 If you are serious about entering the foreign accounting outsourcing industry, this is a must-do course.

Don’t overthink enroll today and transform your career! 🙏

WhatsApp FAOP on 9990884145 for Enrollment details.

Why You Should Enroll Now & Start Your Foreign Accounting Outsourcing Practice

Huge demand from US, UK & AUS for outsourcing

High-paying international clients available

Best time – massive work shifting to India

Early movers capture top global clients

Training on Xero, QuickBooks & live projects

Learn LinkedIn, Upwork & CPA client acquisition

Low investment, high recurring returns

Build global brand & scale your CA firm

Don’t wait – enroll today & start your global journey!

WhatsApp FAOP on 9990884145 for Enrollment details.

Don’t Let This Be Your Biggest Regret

Many CAs and finance professionals had the chance to join our Foreign Accounting Outsourcing Practice (FAOP) course… but they delayed. Today, they’re still stuck with

Traditional practice with limited growth

Clients who don’t pay on time

Stress of low-paying assignments

Watching others grow in global markets

Meanwhile those who joined are now

Working with US/UK clients

Earning in dollars & pounds

Building a scalable outsourcing business

Living a stress-free, growth-focused life

Limited Seats

If you miss this opportunity, you’ll regret watching your peers capture the international market while you’re still waiting for the right time.

The right time is NOW.

Enroll today before it’s too late.

10 solid reasons why you should start your Foreign Accounting Outsourcing Practice now

Global Demand Rising*

US, UK, Canada, and Australia firms are actively outsourcing to India due to cost efficiency.

High Profit Margins*

Outsourcing offers 50–70% cost savings to clients, leaving big margins for service providers.

Post COVID Boom*

Many CAs/Accountants don’t know how to acquire foreign clients or work on their systems (QuickBooks, Xero, etc.).

First Mover Advantage*

Early starters build brand, credibility, and long-term client relationships.

Skill Shortage in West*

CPA firms face talent shortages; India has surplus skilled accountants.

Technology Driven*

Cloud accounting (QuickBooks, Xero, Zoho, etc.) enables smooth offshore collaboration.

Scalable Business Model*

Start solo, then scale with a team and multiple clients.

Recurring Revenue*

Bookkeeping and compliance work bring stable, monthly recurring income.

India’s Global Edge*

English proficiency + CA talent pool makes India the preferred outsourcing hub.

Future-Proof Career*

Outsourcing is expanding rapidly; those who start now will lead the market in 5–10 years.

Why we made FAOP Foreign Accounting Outsourcing Practice) course

Huge Global Demand

US, UK, Canada, Australia, and UAE businesses are outsourcing accounting/bookkeeping to India.

High Earnings Potential

A single client can give recurring revenue of ₹1–2 lakh per month.

Lack of Awareness

3. Many CAs/Accountants don’t know how to acquire foreign clients or work on their systems (QuickBooks, Xero, etc.).

Skill Gap

Traditional CA curriculum focuses on Indian accounting; foreign accounting software & outsourcing model isn’t taught.

Step by Step Guidance Needed

Professionals need a structured course with practical training, real-life examples, and client acquisition strategies.

To Empower CAs & Firms

Our mission is to make 1,000+ CA firms in India capable of running successful outsourcing practices.

First Mover Advantage

Those who start early in foreign outsourcing build long-term recurring revenue streams.

In Short

We made FAOP course to bridge the gap between opportunity and skill, so Indian CAs & accountants can confidently capture global clients and grow 10x.

Don’t think too much About Money

It’s not an expense, it’s an investment.

You’ll always get more value than what you spend.

A single assignment can give you 10x returns.

Take risks, explore new opportunities, and step out of the old routine.

Remember: Investment in knowledge always pays the best interest.

All the best for your journey!

This is the best course you will find on the internet.

Nobody else is providing client acquisition strategies ebooks.

Also nobody is providing a CPA database for collaboration.

Our classes are also 100% practical based and not only theoretical.

We also keep doubts session and mentor support to help you.

What You Should Know Before Enrolling

Basic Accounting Knowledge

A solid foundation in accounting is essential to understand global bookkeeping processes.

Basic English Communication Skills

You should be able to communicate confidently through emails and client calls.

Laptop & Internet Connection

Required for hands-on training on real accounting software and working with international clients.

Career Opportunities after this Course

Foreign Accounting Jobs (WFO & WFH)

Get placed with reputed outsourcing firms or work from the comfort of your home.

Remote Jobs with US/UK/AUS CPAs

Collaborate directly with international firms offering remote opportunities.

Freelancing on Global Platforms

Start taking international projects on Upwork, Fiverr, and other freelancing portals.

Start Your Own Outsourcing Firm

Build your own team and serve global clients from India.

Pursue ACCA / CPA

Add international qualifications to your profile for even higher growth.

Join CA Firms Offering Global Services

Become part of leading Indian firms working with international clients.

Who Should Join This Course

This program is perfect for you if you want to build a high-income career in global accounting and remote finance jobs.

You should join if you are

A Chartered Accountant

(CA, CS, CMA) Want to expand your practice globally or get international accounting exposure through US, UK & Australian clients.

A Semi Qualified CA or CA Student

Looking to earn in dollars while learning practical foreign accounting tools like QuickBooks, Xero & Payroll systems.

A Commerce Graduate or Postgraduate

Aspiring to build a stable, well-paying career in international bookkeeping, taxation, and outsourcing.

An Accountant Working in an Indian Firm

Ready to upskill and switch from local accounting to high-paying global opportunities.

A Working Professional Seeking Remote Jobs

Dreaming of flexible work-from-home roles with clients across the world.

A Freelancer or Virtual Assistant (Finance Domain)

Wanting to add foreign accounting services to your portfolio and increase your earning potential 3X–5X.

Process of Starting Foreign Accounting Outsourcing Practice after enrollment

The Solution Our Recorded Program

Foreign Accounting & Bookkeeping Outsourcing Practice A complete step-by-step recorded course by SJ MENTORSHIP GROUP that shows you how to

QuickBooks Online (QBO) Learning Manual

1. Chart of Accounts Setup & Custom Books

Learn how to create and organize accounts for various business types. Understand categories like income, expenses, assets, liabilities, and equity. Customize books based on client-specific needs.

2. Opening Balances & Trial Balance

How to input historical data when onboarding new clients and reconcile opening balances. Preparation and interpretation of a trial balance to ensure books are accurate

3. Transaction Recording & Journal Entries

Record day-to-day transactions such as sales, purchases, and expenses. Learn manual journal entries to correct or adjust accounting errors.

4. Bank Reconciliation

Match bank transactions with recorded entries in QuickBooks. Identify discrepancies, missing entries, or bank charges to ensure cash book accuracy.

5. Accounts Receivable & Payable

Manage client receivables: Create and send invoices, follow up on overdue payments. Handle payables: Record bills, track due dates, and schedule payments.

6. Invoice & Bill Generation

Automate and customize invoices/bills with tax fields, payment terms, and branding. Link these with customer/vendor ledgers for real-time tracking.

7. Financial Reports

Generate and analyze core financial reports:

• Balance Sheet – Understand financial position (Assets = Liabilities + Equity)

• Profit & Loss (P&L) – Analyze revenue, expenses, and net income

• Ageing Analysis – Track overdue invoices and bills to improve cash flow

Xero Accounting (xero) learning manual

1. Client Setup & Company Creation

Create a new organization in Xero, set currency, tax defaults, and financial year. Input business details and connect bank feeds

2. Balance Conversion & Chart of Accounts

Transfer existing client balances from Excel or other software. Import or customize the chart of accounts suitable for various industries.

3. Bank Rules & Ledger Management

Automate transaction categorization using bank rules. Understand the general ledger, coding transactions, and tracking audit trails.

4. Journal Entries

Manual journal posting for adjustments, accruals, and corrections. Learn about tracking categories and tracking for departmental reports.

5. Asset Addition & Depreciation

Use Xero’s fixed asset module to add and track business assets. Automate monthly depreciation and understand asset disposal procedures.

6. Bank Reconciliation

Perform daily or weekly bank reconciliation to ensure books match real-time cash flow. Handle unmatched transactions and reconciliation errors.

7. Financial Statement Preparation

Compile complete financial statements:

• Balance Sheet

• Profit & Loss

• Statement of Cash Flows

• Management Reports (KPIs, Budget vs Actual, etc.)

Carrer Opportunities

- Foreign Accounting Jobs (WFO & WFH)

- Freelancing on platforms like Upwork, Fiverr, etc.

- Remote jobs with US/UK/AUS CPAs

- For Doing ACCA / CPA

- Setting up your own outsourcing practice

- Joining CA firms offering global services.

Here's What You Will Get !

Practical Recorded Trainings

20+ Hours of Recorded Practical Training

Learn QuickBooks & Xero software with real-life accounting and bookkeeping case studies.

EBooks

15 Client Acquisition E-books (20 Pages Each)

Master strategies to find international clients via LinkedIn, Upwork, CPA databases, cold calls, and more.

CPA Database

3 Lakh+ CPA Contacts (India & Abroad)

Get verified email IDs & WhatsApp numbers of CPA firms across US, UK, Canada, Australia, Singapore, UAE & more.

Master Client Acquisition 10 Ebooks

What you will get in the course

(CPA firms across US, UK, Canada, Australia, Singapore, UAE & more)

Working with Indian Clients Vs Working with Global Clients

Working with US/UK Clients

- Earn 3x 5x more with payments in foreign currency

- Get recurring monthly retainers instead of one-time work

- Use modern cloud systems (QuickBooks, Xero)

- Gain global exposure & credibility

- Clients value expertise and pay without excessive bargaining

Working with Indian Clients

- Lower fees due to market competition

- Mostly short-term projects, not recurring

- Reliance on outdated/manual systems

- Limited growth potential

- Frequent price negotiations

- Risk of Litigations

Linkedin Recommendations

Meet the Founder

CA Siddharth Jain

- Chartered Accountant & Founder of SJ Mentorship Group Trained and guided 1000+ CAs & professionals

- Expert in foreign accounting outsourcing & business strategy

- Known for practical, result-driven mentorship

- Mission: To help Indian professionals go global

My Article in Various Magazines

Our TESTIMONIAL

Frequently Asked Questions

Is this course live or recorded?

It’s fully recorded learn at your own pace.

Do I need prior outsourcing experience?

No, we start from the basics and guide you step by step.

Will I learn software like QuickBooks & Xero?

Yes, complete hands-on training is included.

How soon can I get clients?

Students have onboarded clients within 30–60 days.

Do I get lifetime access?

Yes, with free updates.

COPYRIGHT 2025. All Rights Reserved SJ MENTORSHIP GROUP